Targeted

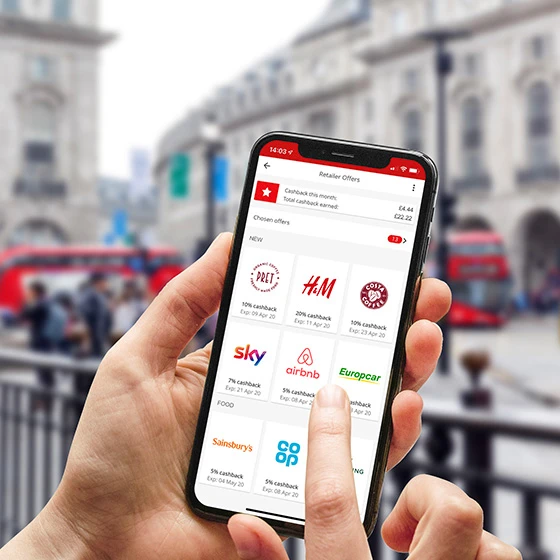

Offers App & Open Banking Integration

Created an Cardlytics’ technology is integrated into numerous banking and financial apps you might already be using, providing you with personalized cashback rewards based on your spending.

20+

Prototypes for

different clients

Project Details

This was part of a larger piece of work.

Client: Sainsbury’s Nectar (Cardytics)

Part of a small 3 person team to create a new product.

Duration: 1 1/2 years

Contract position

Roll: Lead Product Designer

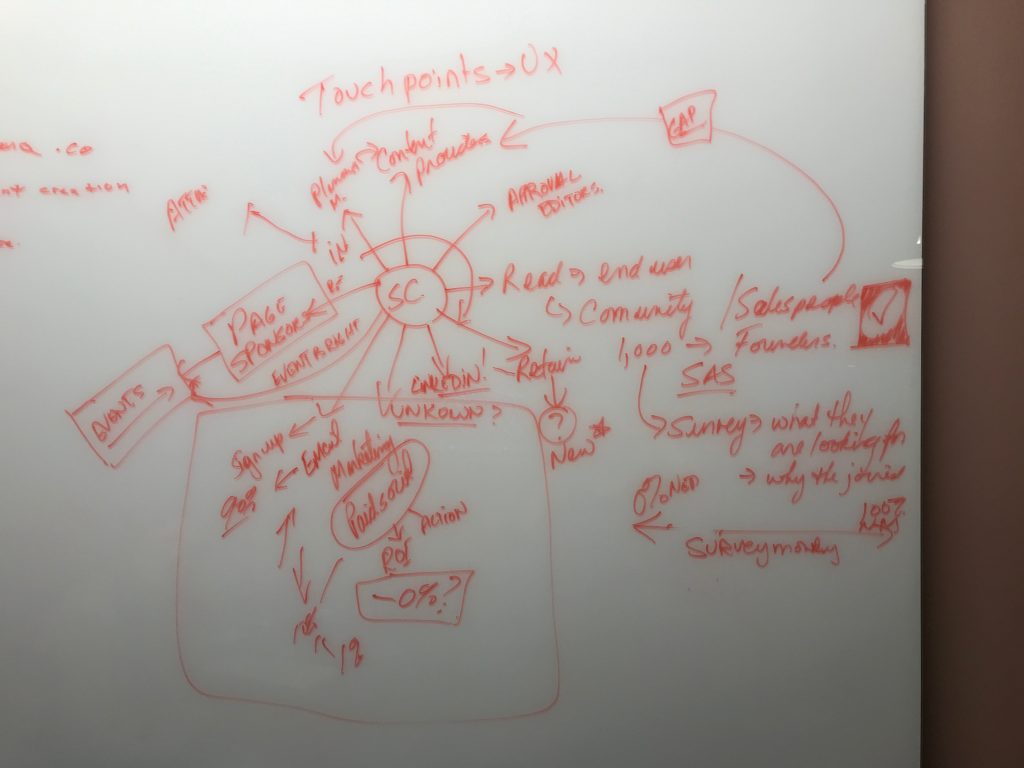

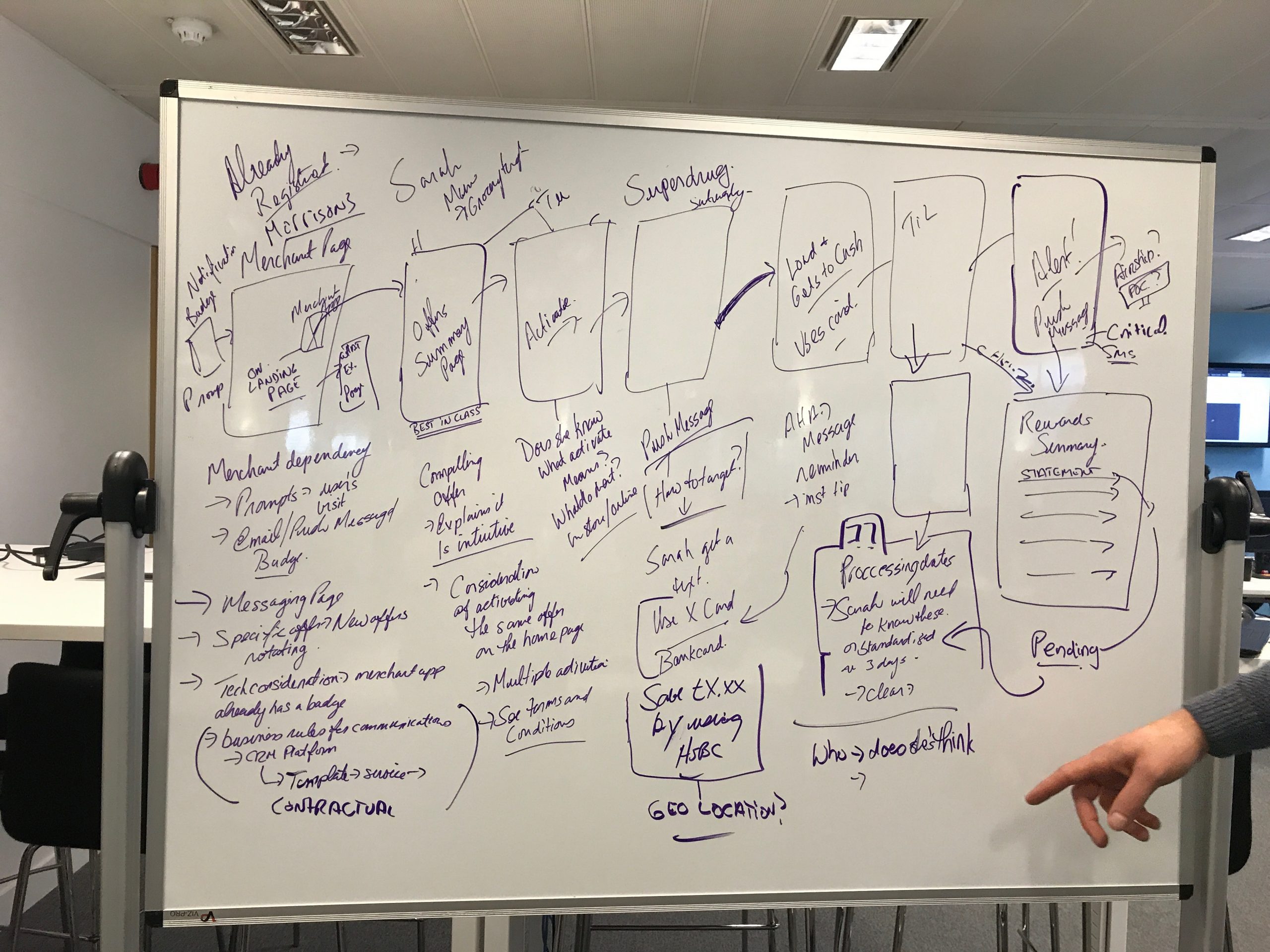

- Product Design scoping and mapping (blueprints)

- User research

- User testing and continual iterations

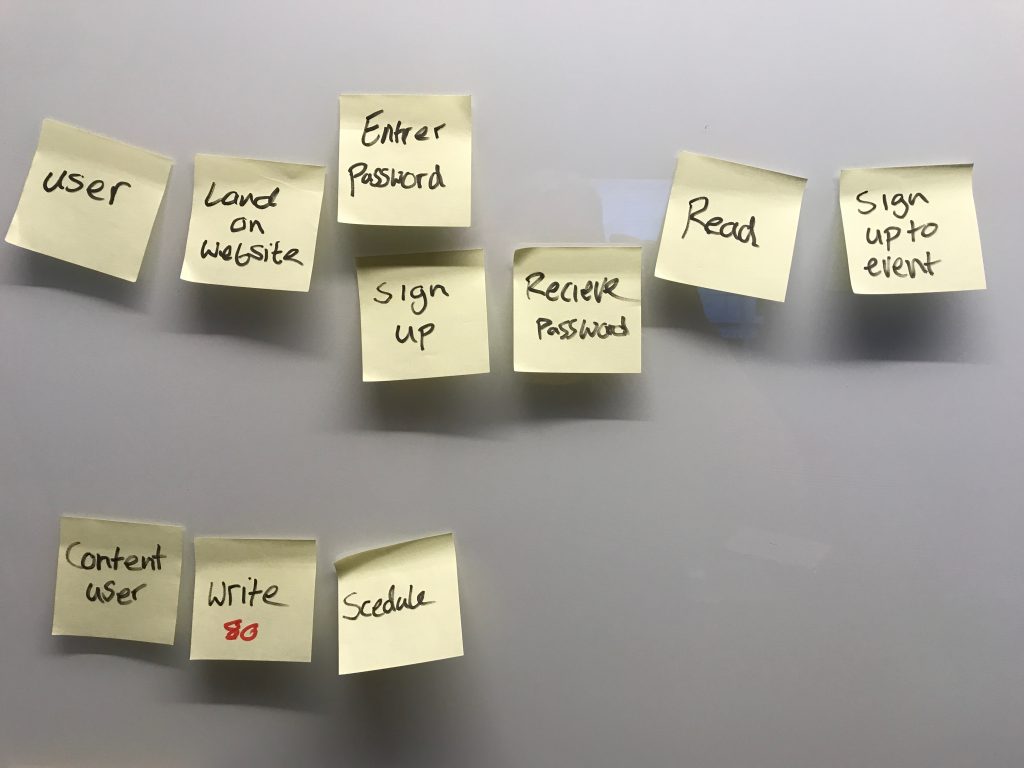

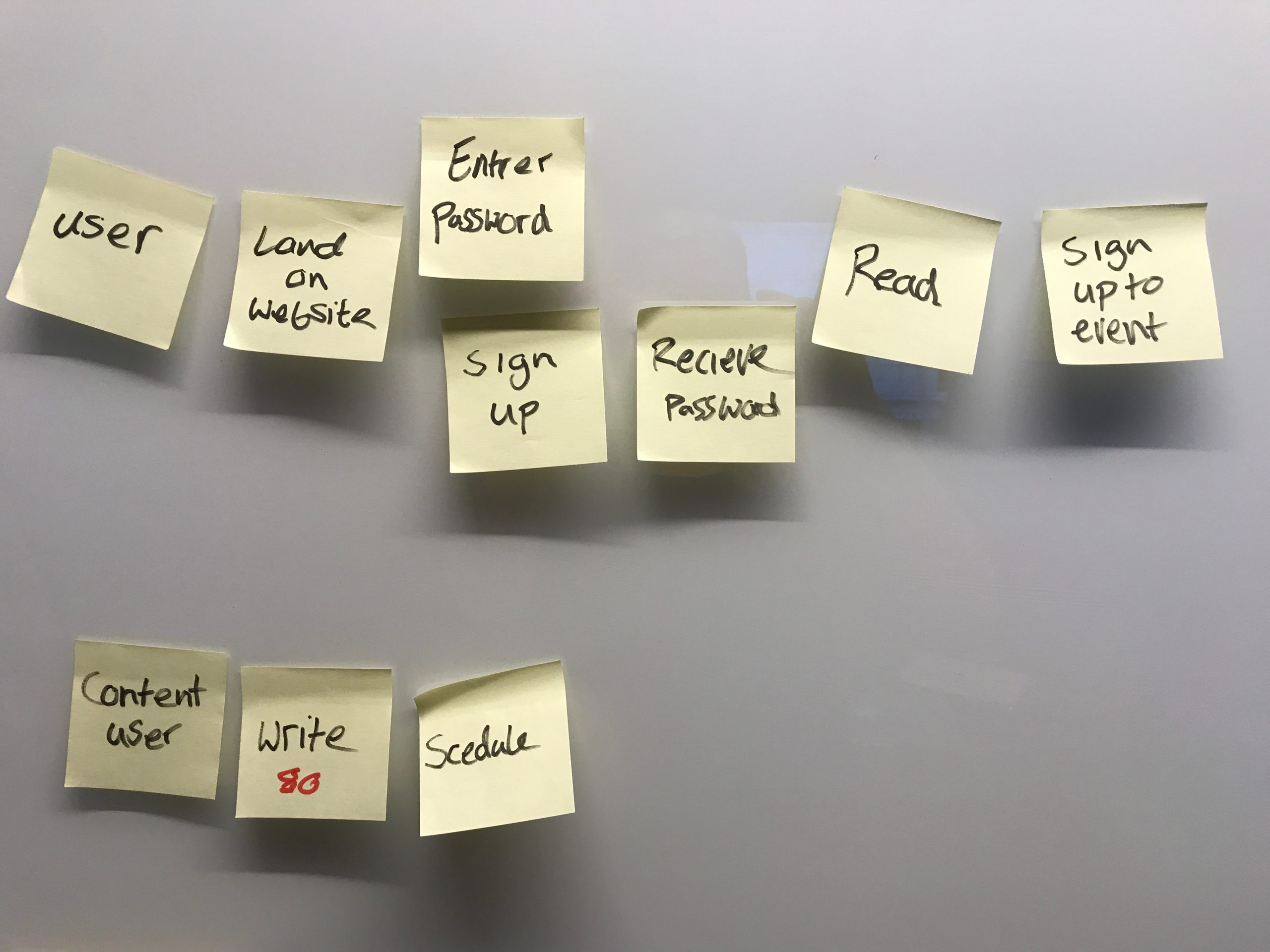

- User journeys and flows

- UX Design

- Prototyping

- Visual design and branding

- Personas

Scope: Full UX, UR and UI Design

- Proof of concept

- Test proposition with end users

- Recruit end users

- User journeys and flows

- Technical scoping and

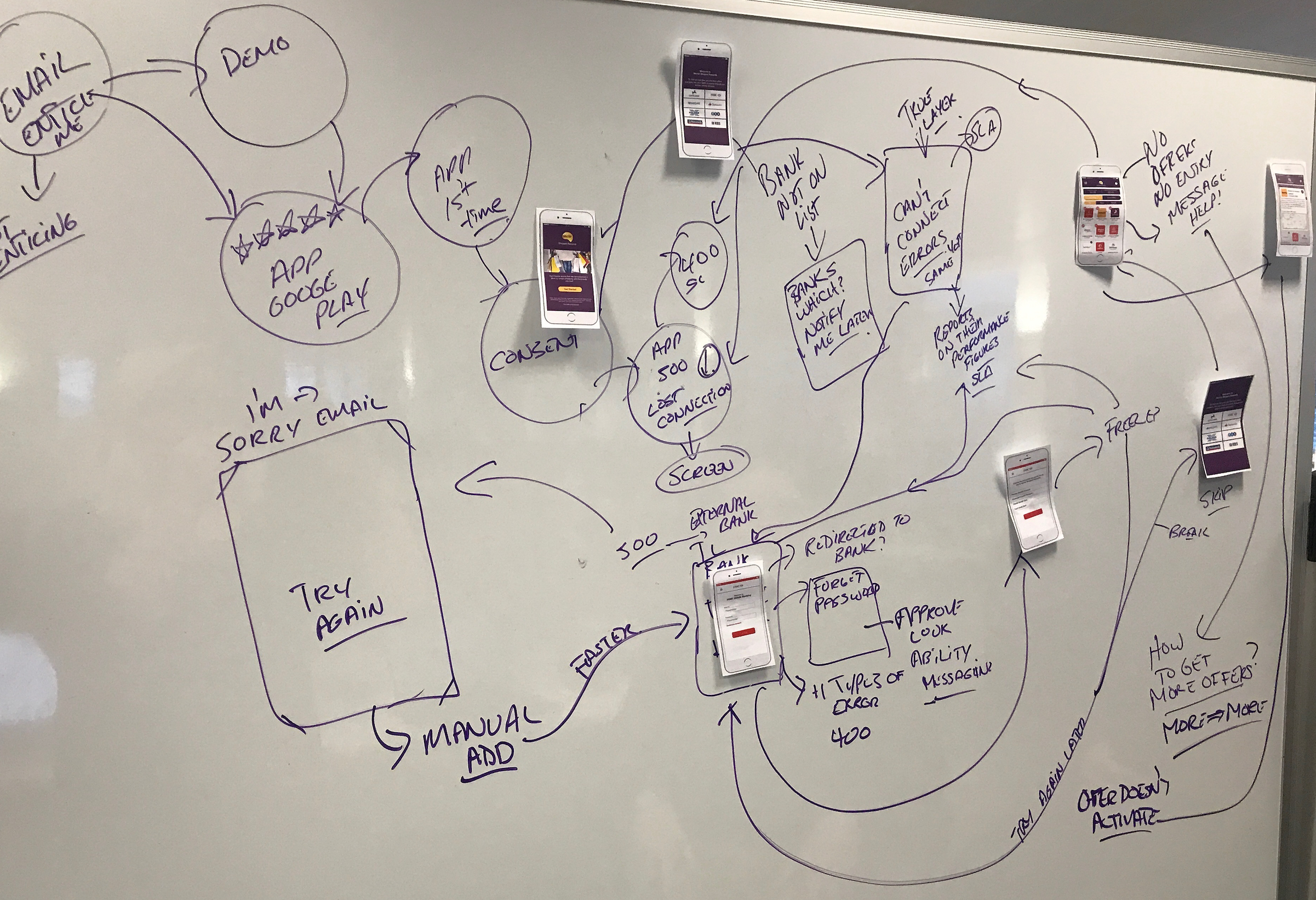

- Fully working prototype

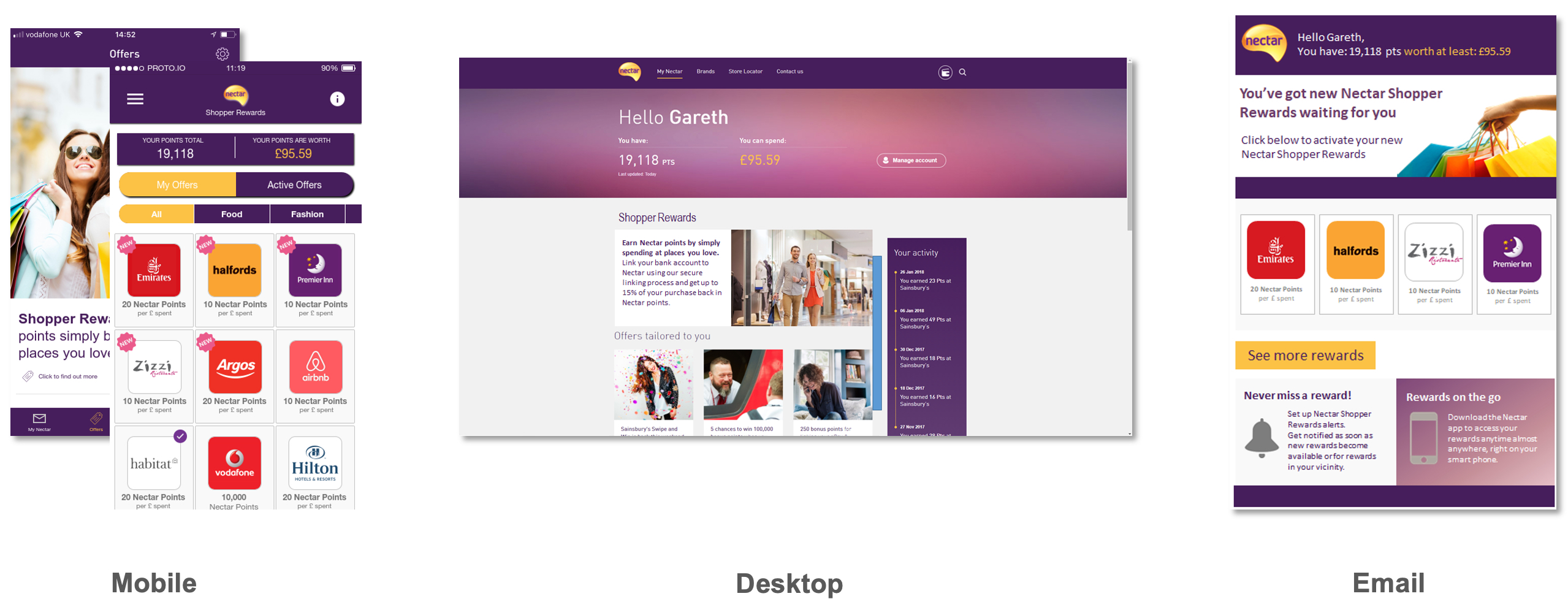

- Mobile first with web and email

Tasks

My task was to take a raw idea from a long term and former manager’s head and to create a fully working and branded prototypes that he can show and demonstrate to prospective clients.

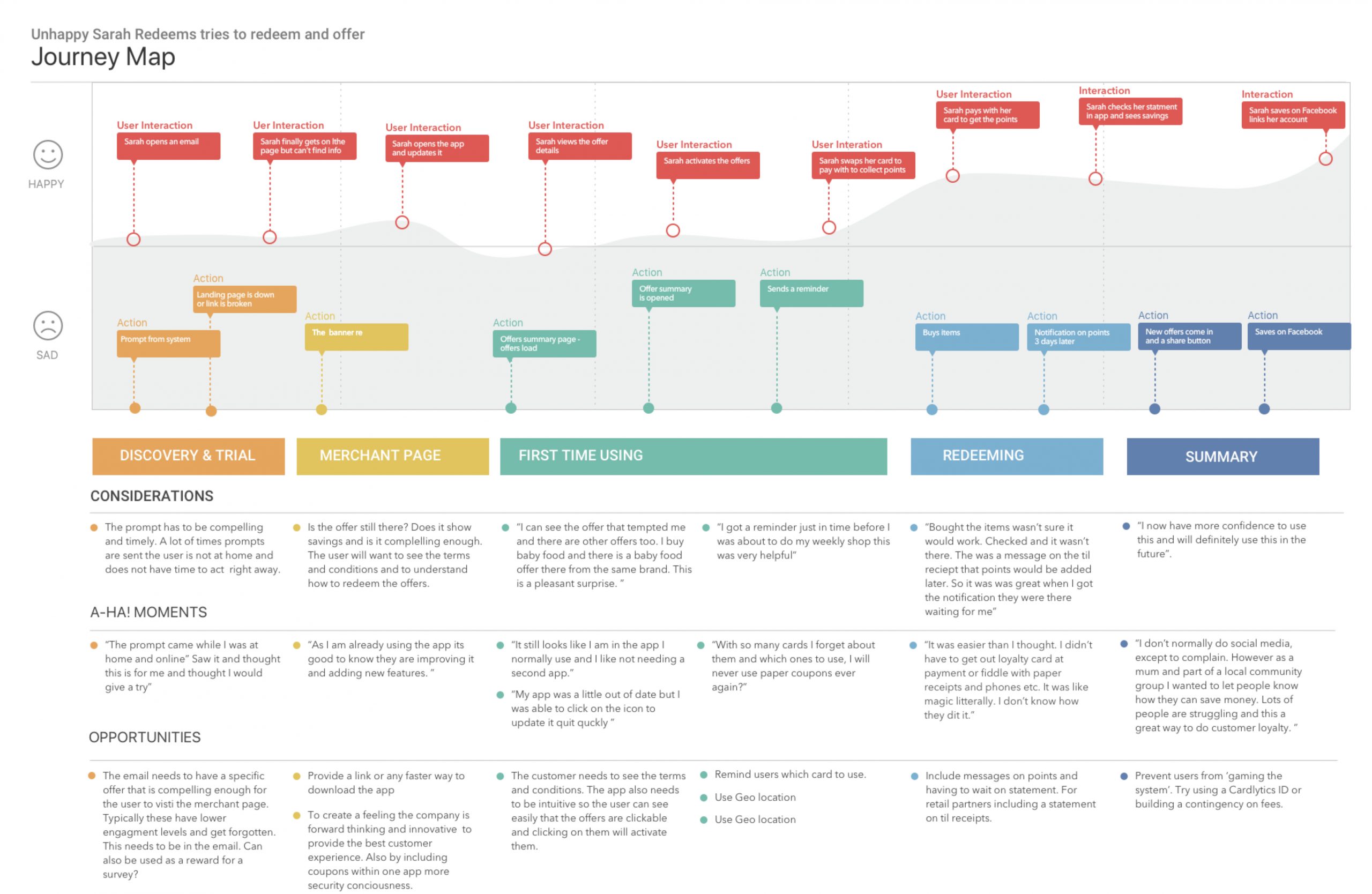

The idea also needed to be fully validated. So I set up a user research and testing lab in a unused small office with Tobii eye tracking. Rather than include this as a step in the process (at right) I chose instead to embed it in each step as continual testing. So at every point in the development the concepts, hypothesises and detailed would be tested & iterated.

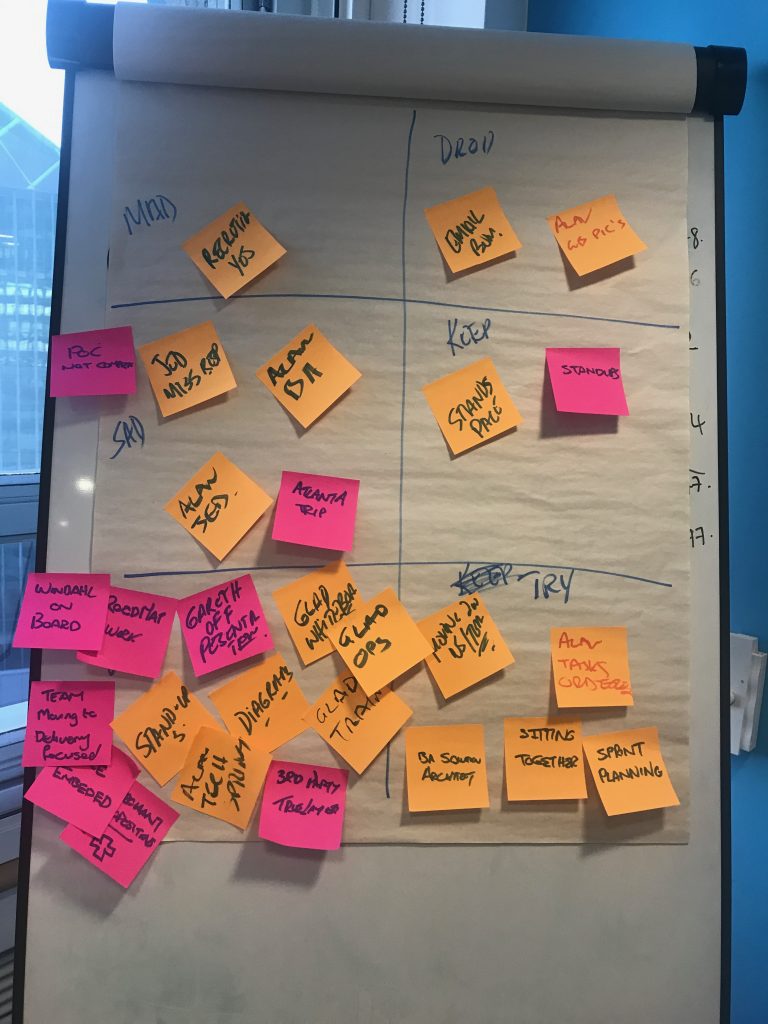

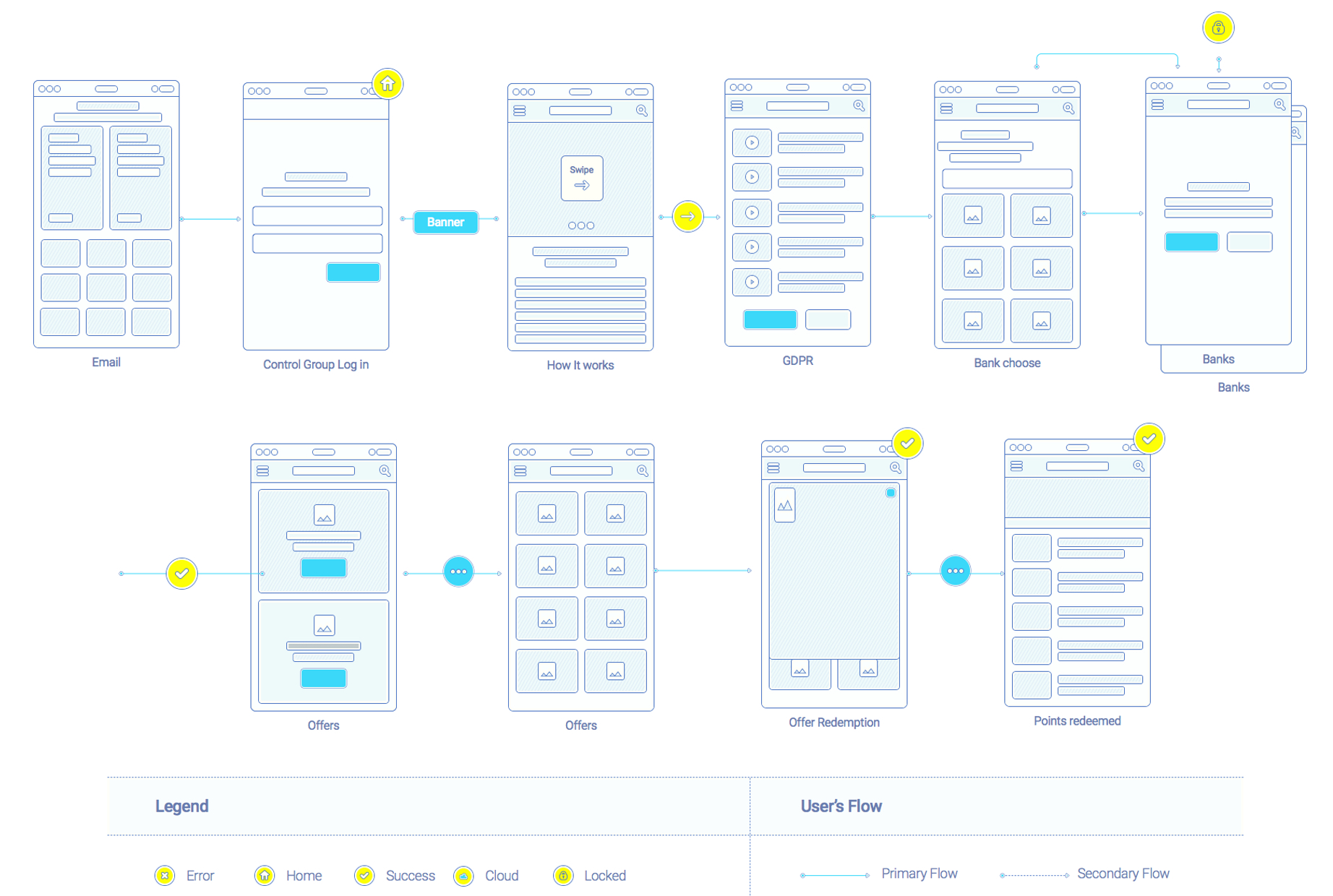

I used an iterative design model to that included sketching out and capturing the idea quickly and having a morning stand up plus an iteration session.

Each day I would move the concept further with mock ups and play these back to the team.

I worked closely with the BA and project sponsor to capture the ideas and get an idea of the functionality. Starting with a few conceptual mock ups I added these to the board so we could visualise and the expand the functionality capturing all the various use cases and scenarios.

Activities

Using a mobile first approach.

Results

After a successful pilot with Sainsbury’s the app was picked up by numerous retailers and integrated into banks.

I was surprised by the conceptual research myself as I expected one of the hurdles would have been people’s willingness to pair their bank ‘spending data’ with the app and major retailers. People turned out to be rewards driven and trusted the high quality brands we were working with such as Sainsbury’s, Marks & Spencer, Boots and Argos.

The ease of use of the app compared to the ‘one time’ set up was found not to be as much of a burden as I had feared.

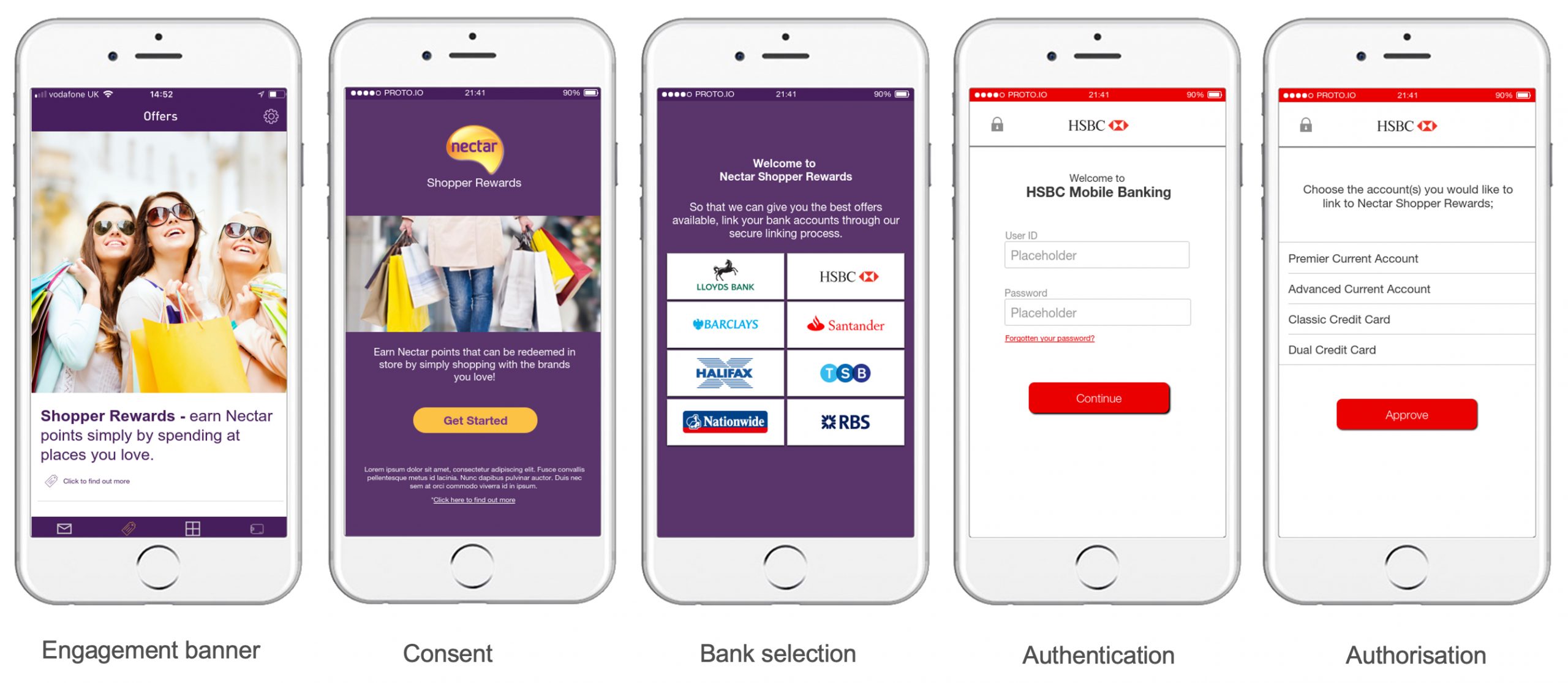

I did try to make it as smooth as possible and offered two solutions which were both compliant legally and secure. However both very different experiences. These were extensively tested with users to see which they preferred.

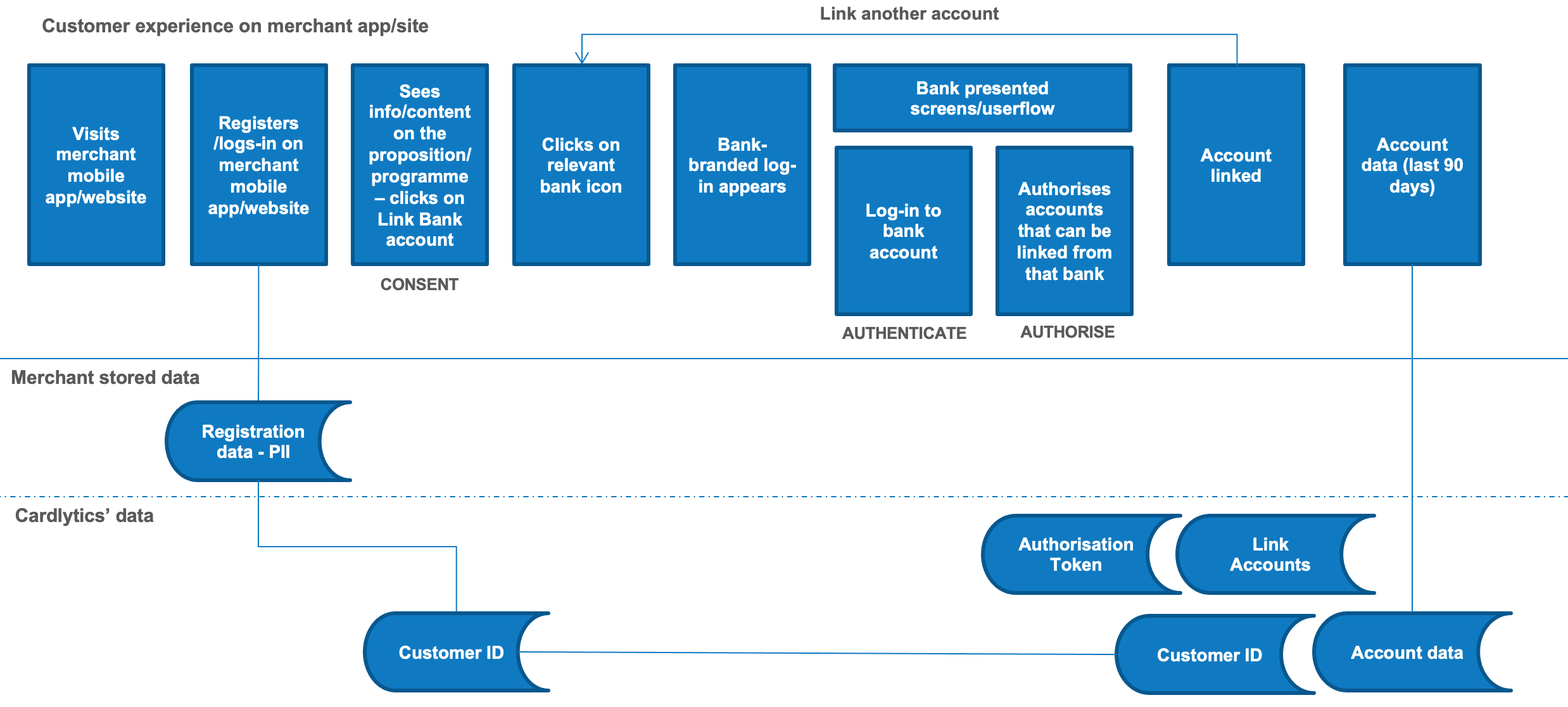

Because they would be directly linking these with their bank the app would have to ‘pass them over’ to their bank. This would mean that we would not be able to control the journey after that point. However they would have the added re-assurance it really is their bank.

After a short break I was then rehired for a second contract for a more ambitious project.

Key Features of Cardlytics-Powered Offers (within partner apps):

- Personalized Offers: Rewards and cashback deals are tailored to your past spending habits, making them more relevant.

- Cashback Rewards: The most common type of offer is cashback, which is directly credited to your bank or app account.

- Ease of Use: Offers are typically automatically applied when you use your linked card, eliminating the need for manual activation or coupon codes.

- Wide Range of Merchants: Offers can come from various retailers, restaurants, entertainment venues, and online services.

- Real-time Notifications (in some cases): Some integrations provide real-time notifications of cashback earned after a purchase.

- Tracking and Management: Within the banking or partner app, you can usually track the offers you’ve activated and the cashback you’ve earned.

Outcome for Carlytics:

Banking Apps: Major banks like Lloyds Bank, Halifax, and Bank of Scotland in the UK (as of recent reports in April 2025) integrate Cardlytics technology directly into their mobile banking apps. Users can find a dedicated rewards or cashback section within these apps showcasing personalized offers.

This has now been rolled out across multiple brands and used by millions of users.